dog medical insurance plans with practical depth

Coverage decisions feel clearer when you understand how policies behave on the messy days, not just the sunny ones. A soft-expert view focuses on structure, exclusions, and timelines so you can act with steady confidence rather than guesswork.

What coverage actually includes (and what it quietly skips)

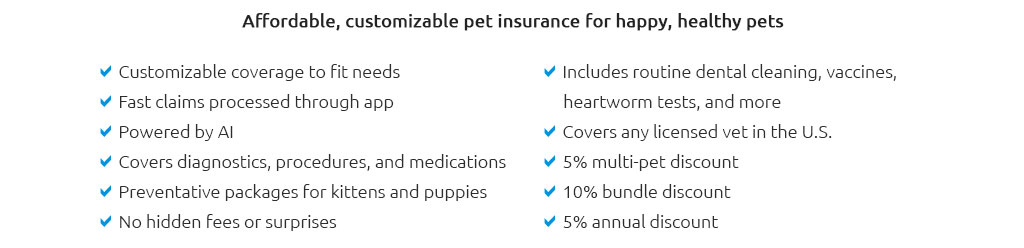

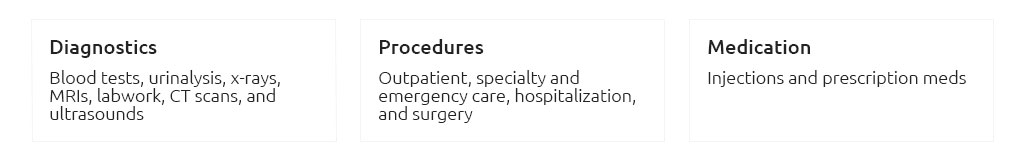

Most insurers bucket benefits into accident and illness, then layer options. The nuance lives in definitions and caps.

- Core medical: diagnostics, imaging, hospitalization, surgery, ER fees, and meds tied to a covered event.

- Chronic and hereditary conditions: diabetes, IVDD, hip dysplasia, allergies; look for lifetime coverage without condition-specific caps.

- Rehab and complementary care: hydrotherapy, laser, acupuncture - often covered if prescribed, but limits apply.

- Dental: accidents to teeth are usually covered; periodontal disease often sits behind a wellness or dental rider.

- Behavioral care: sometimes included if veterinarian-directed; definition matters.

- Tele-vet: triage consults included by some plans, a quiet time-saver during off-hours.

Pre-existing conditions are broadly excluded. Some carriers forgive curable issues after a symptom-free window; others never do. Waiting periods can separate accidents from orthopedic illness; a dedicated orthopedic exam may shorten that clock.

The reimbursement math that shapes real outcomes

Think in layers: deductible (per-incident vs annual), then reimbursement percentage (70 - 90%), then any annual or lifetime limits. The same invoice can produce very different out-of-pocket costs depending on these gears.

- Annual deductible: simpler for multi-issue years; set it where routine spend won't meet it, but serious care will.

- Per-incident deductible: useful if you expect one-off events; less friendly for allergy seasons or recurring GI flares.

- Coinsurance: 10 - 30% typically; increasing your share lowers premium but raises volatility.

- Benefit limits: prefer no lifetime caps; generous annual limits protect against oncology and advanced surgery cascades.

- Repricing and fees: ER facility charges count, but exam-fee coverage can be excluded unless added - small line items add up.

A quiet real-world moment

At 7:40 p.m. on a wet Tuesday, a guardian snapped a photo of a Lab's swollen paw and used the insurer's tele-vet. The nurse flagged likely foxtail, approved an ER visit, and the claim pre-authorization meant the clinic submitted directly. The owner still paid the deductible, but the fast green light kept focus on the dog, not paperwork.

Underwriting texture: age, breed, and bilateral language

Puppy enrollments lock in lower rates and broader future eligibility. Senior enrollments remain valuable but may exclude cruciate injuries or impose orthopedic waiting periods. Bilateral clauses matter: if one knee goes pre-policy, the other may be excluded. Breeds with known predispositions (brachycephalic airways, large-breed joints) heighten the need for high annual limits and exam-fee coverage.

Comparing options without forcing a purchase mind-set

- Map your dog's history: prior meds, surgeries, intermittent symptoms; note exact dates.

- Request quotes at two reimbursement levels; record the deductible breakpoints.

- Simulate a bad year: one ER visit, one imaging-heavy illness, one rehab block; run the math across plans.

- Read sample policies for exclusions, waiting periods, and definitions (illness, accident, behavioral).

- Check claim channels: app-based e-claims, direct pay availability, and typical reimbursement days.

- Revisit annually; adjust deductible as reserves improve or health patterns change.

Signals of a mature insurer

- Transparent policy forms and a searchable knowledge base.

- Average payout times published and consistent (sub-7 business days is reassuring).

- No lifetime caps; clear inflation practices; stable renewal logic after claims.

- Orthopedic exam waiver path to shorten waits.

- International travel coverage and referral-friendly specialty rules.

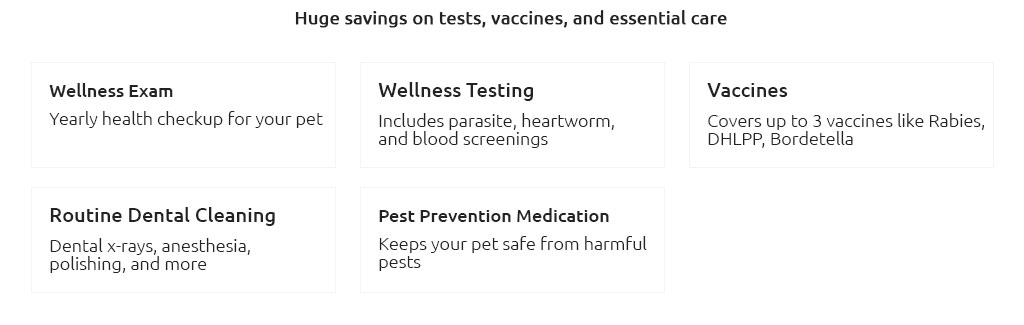

Wellness add-ons rarely "pay off" dollar-for-dollar; they can, however, smooth cash flow and remind you to keep vaccines, fecals, and cleanings on cadence. Medical coverage remains the real shield against volatility.

What experienced owners often do

- Select a high annual limit with exam-fee coverage, then set an annual deductible that fits their emergency fund.

- Keep personal reserves for small issues; let insurance handle imaging, surgery, and oncology.

- Document everything: invoices, discharge notes, and vet narratives speed claims and resolve edge cases.

- Review mid-policy after a new diagnosis; confirm future eligibility in writing.

Confidence grows with familiarity: a clear deductible, predictable timelines, and a plan you've test-driven with a small claim before the big one. The goal is steady care with fewer surprises, and there's room to refine as your dog - and your tolerance for risk - evolves.